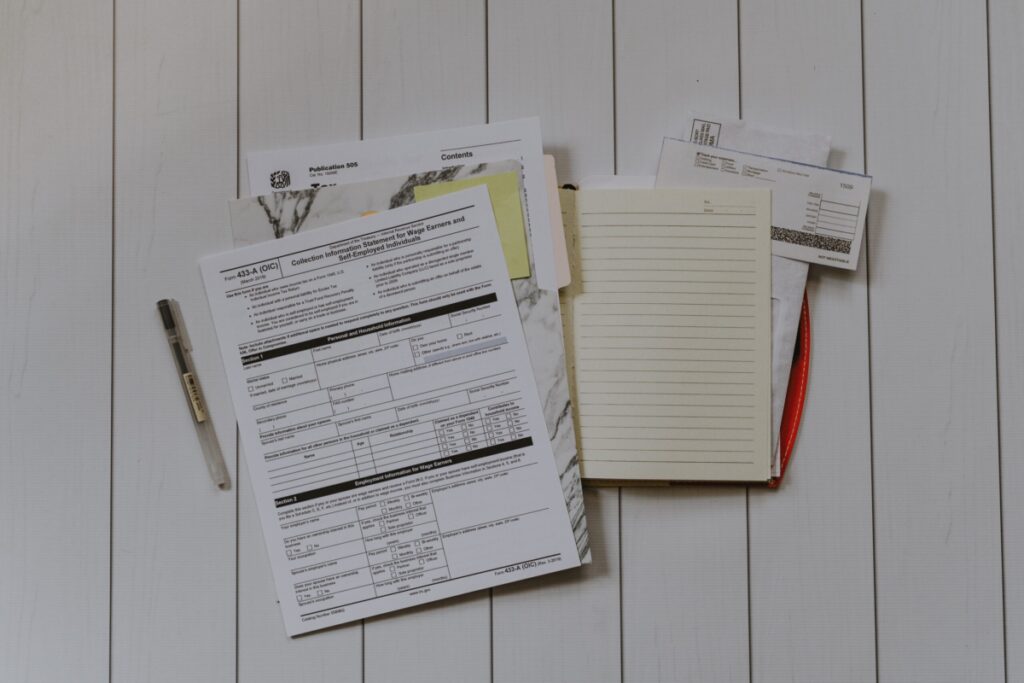

The basic two documents required for customs clearance is a customs client code for your business and a purchase invoice for the goods.

If you don’t have a Customs Client Code you will need to fill in the NZCS224 form and return it to us with a copy of all the directors passports.

Goods always have a value for customs purposes even if you receive goods for free or samples for free your supplier must state a value for customs purposes only on an invoice. Customs rules states everything has a value so it must be supplied.

All imports for businesses are taxable and must be cleared by a registered customs broker like Rocket Freight.

Many goods can require substantially more documentation in order for us to clear look at our FAQ for more information, fill out and enquiry form or give us a call we are here to assist you to get your product to market.